Content

A paragraph 162 exchange or team fundamentally has any pastime when the the connection’s number one purpose for engaging in the game is for money otherwise cash and the connection are active in the hobby with continuity and you will volume. More resources for what qualifies since the a swap otherwise business to have reason for section 199A, comprehend the Guidelines to possess Setting 8995, Qualified Company Money Deduction Simplified Calculation; and/or Recommendations for Mode 8995-An excellent, Certified Company Money Deduction. In the Seasons step 1, a collaboration borrows $1,one hundred thousand (PS Responsibility 1) away from Bank 1 and you can $1,100000 (PS Responsibility 2) from Bank dos.

File – casino games for money

For example, they decides the newest bookkeeping means and you may depreciation actions it does fool around with. The partnership as well as makes elections within the following the areas. Whenever a partnership’s federal come back is amended otherwise changed for need, this may change the partnership’s state tax get back.

Google Spend

Form 8938 need to be submitted yearly the worth of the brand new partnership’s given foreign monetary possessions match or exceeds the fresh reporting tolerance. For additional info on home-based partnerships that will be specified residential entities plus the kind of overseas financial possessions that really must be advertised, understand the Tips for Form 8938. Get into all other exchange otherwise company income (loss) maybe not provided on the contours 1a due to six. Such as, don’t were terrible receipts out of farming on the web 1a. In addition to, usually do not tend to be online 1a rental interest income otherwise profile income. For laws from whether or not a different connection need to document Setting 1065, see Whom Have to File , earlier.

On every Agenda K-step 1, go into the term, address, and pinpointing amount of the partnership. When attaching comments so you can Schedule K-step one to help you report more information on the companion, mean you will find an announcement for the following. To ensure that sometimes an advertising otherwise a DI to have big exposure, they must build by themselves open to fulfill myself for the Internal revenue service in america from the a while and set since the influenced by the fresh Internal revenue service, and ought to features a road target in the united states, an excellent U.S.

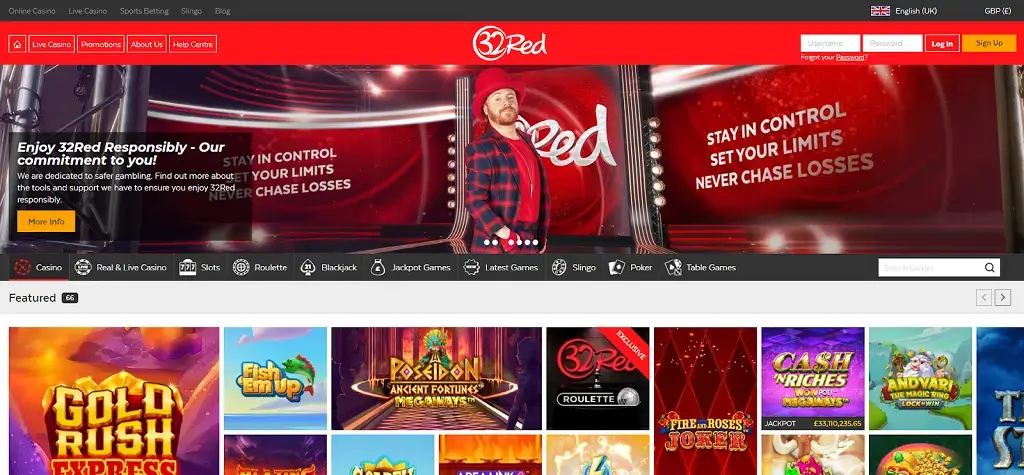

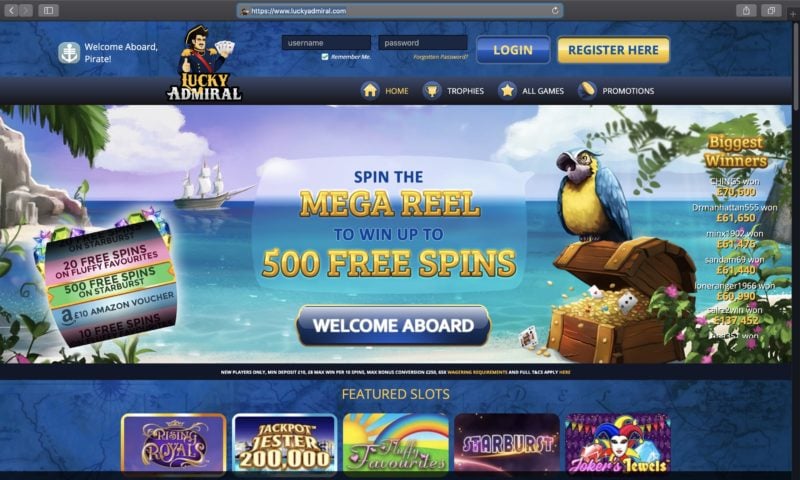

For the Partnership X’s Form 1065, it must respond to “Yes” so you can matter 2b away from Agenda B. Find Example 2 from the tips to own Agenda B-1 (Setting 1065) to own tips on providing the rest of the information required from entities answering “Yes” to that question. Do not deduct repayments casino games for money to have couples in order to later years or deferred payment preparations and IRAs, licensed preparations, and you may simplified employee retirement (SEP) and simple IRA agreements on this line. These types of quantity try stated within the box 13 from Schedule K-step 1 playing with code Roentgen and they are deducted by the lovers to the her output.

Net Investment Taxation Reporting Requirements

While the people are usually permitted to make this election, the connection can’t deduct these amounts otherwise are her or him since the AMT points to the Schedule K-1. As an alternative, the partnership undergoes all the information the brand new people must shape their separate deductions. On the internet 13d(1), enter the kind of costs stated on the internet 13d(2). Enter into online 13d(2) the fresh licensed expenses paid otherwise incurred inside the income tax year to own and that an enthusiastic election under part 59(e) can get apply. Go into which matter for everyone lovers even when any partner can make an enthusiastic election less than section 59(e).

Time Witch

Right here, the newest implicated are extremely women and frequently confronted with torture before getting killed or forced to flee. India’s Federal Crime Details Agency filed 2,468 murders stemming from witchcraft allegations anywhere between 2001 and you will 2016, a variety you to definitely likely doesn’t account for all experience and which does not include examples in which implicated witches lasted their experience. Whether or not these types of persecutions is actually unlawful and other Indian states have enacted legislation concentrating on the new practice, it continues to endure.

If the union produced a keen election so you can subtract a fraction of its reforestation expenditures to your Schedule K, line 13e, it ought to amortize more than an 84-few days months the new part of such costs more than the newest matter subtracted on the Plan K (come across section 194). Deduct online 21 precisely the amortization of them too much reforestation costs. Enter the partnership’s efforts so you can employee work with programs perhaps not advertised somewhere else to the return (including, insurance policies, wellness, and you may hobbies software) that aren’t part of a pension, profit-discussing, etc., plan incorporated on the internet 18. If the partnership says a good deduction to own timber depletion, complete and you may install Function T (Timber), Forest Issues Plan.

Mount a statement to help you Schedule K-1 proving the new partner’s distributive share of one’s number your companion uses to figure the fresh amounts so you can writeup on its Mode 3468, Part II. Should your connection holds a primary or indirect interest in an RPE you to aggregates several deals or companies, the partnership must also is a duplicate of your RPE’s aggregations with each mate’s Schedule K-step one. The connection can’t break apart the new aggregation of another RPE, nonetheless it get put deals otherwise businesses to your aggregation, and in case the fresh aggregation criteria try came across.

How Money Try Shared Certainly Lovers

The partnership switches into the new corrective means with regards to possessions Y. In the 1st season, P has $10 out of section 704(b) book decline, that’s designated similarly to help you An excellent and you may B for publication objectives ($5 for each). But not, P features $0 out of taxation depreciation regarding possessions Y. Beneath the remedial approach, to own taxation objectives, P allocates $5 out of corrective money to help you A great and you may $5 of an excellent corrective decline deduction to B with regards to property Y. The new definitions for the statement generally fulfill the descriptions stated on the Agenda K-1.

Online passive earnings out of a rental hobby try nonpassive money if the lower than 29% of your own unadjusted foundation of the home made use of otherwise stored to possess explore by people from the hobby is actually at the mercy of decline less than section 167. Other Internet Local rental Income (Loss) , later on, to own revealing most other web local rental money (loss) apart from leasing a home. If the someone partcipates in an exchange to your connection, besides regarding the ability while the somebody, the newest companion try treated since the not being a part of the partnership regarding purchase. Unique legislation apply to conversion otherwise exchanges of assets anywhere between partnerships and you will certain persons, while the told me within the Club. Fundamentally, the relationship decides tips shape income from the functions.

Gain Deferral Approach

As well, an ensured commission explained inside the point 707(c) is not earnings from accommodations pastime. For those who aggregate your own issues under these types of regulations to possess point 465 motives, read the appropriate package inside product K underneath the label and you may address cut off to your webpage step 1 out of Setting 1065. Attach a copy from Form 8832 to the partnership’s Setting 1065 to your income tax year of your own election. If a couple of number is added to profile extent to get in to your a line, are cents when incorporating the new amounts and you will round away from just the overall. A collaboration is generally required to have one of your own following income tax years. There are many instances when the partnership can acquire automatic concur regarding the Internal revenue service to change to certain bookkeeping tips.

In some cases the new implicated witch you will up coming be experienced and you may likely to either elevator the brand new curse otherwise pay settlement. Even when witches are considered getting person, in lot of societies he or she is credited having big efficiency perhaps not mutual from the many people. The theory you to definitely witches is travel is discovered not only in very early progressive Europe (a period of time within the fifteenth to seventeenth centuries) but also inside the areas of United states, sub-Saharan Africa, Southern area China, and you will Melanesia. In some cases it allegedly do it up on steeds; the above mentioned Nyakyusa for instance held so you can a conviction one to witches travelled on their pythons, when you are of very early progressive Europe you’ll find profile from witches riding through to broomsticks.

Although not, it was around the fifteenth century that the Christian church deemed witches “happy disciples” of one’s demon, unveiling a campaign away from query and you may carrying out believed witches in the European countries and you can America one endured almost three hundred many years, with regards to the Library of Congress. “The idea of magic pages otherwise people who did miracle are in almost any society, it doesn’t matter how far back you are going,” claims Blake. Actually, considering Mar, witch means very aren’t far unique of traditional prayers. Another difference in Wiccans and you can witches is that of numerous Wiccans abide by Wiccan Rede, an excellent credo you to definitely claims “Spoil not one and you may create as you will,” and this generally function you are free to manage because you excite, unless of course it negatively impacts anyone else. Even though many people explore “witch” and you can “Wiccan” interchangeably, they aren’t always a similar thing.